New Legislation Reinstates 100% Bonus Depreciation: Here’s What It Means for Real Estate Investors

- Granite Towers Equity Group

- Aug 7, 2025

- 2 min read

Updated: Aug 11, 2025

Recent legislative changes have reinstated 100% bonus depreciation, creating a powerful opportunity for real estate investors to enhance after-tax returns and strategically position their capital.

What is 100% Bonus Depreciation

Bonus depreciation allows investors to write off a significant portion of their investment in the same year the asset is placed in service. With the return of the 100% provision, a substantial part of an investment in multifamily real estate can now be depreciated in the year of purchase.

For passive investors, this typically results in a large depreciation loss reported on your K-1. This loss may be used to offset:

Passive income from the same investment

Income from other passive investments

Capital gains

And, depending on your tax situation, potentially other types of income

Why This Matters: Tax Advantaged Investing

The primary benefit of 100% bonus depreciation is the ability to significantly reduce taxable income, which can increase after-tax returns and free up capital for future investments.

For example, an investor who puts $100,000 into a qualifying real estate project could receive between $65,000 and $75,000 in depreciation losses in the first year.

This immediate tax relief amplifies return potential and offers greater financial flexibility when planning future investments.

How It Works: Cost Segregation Studies

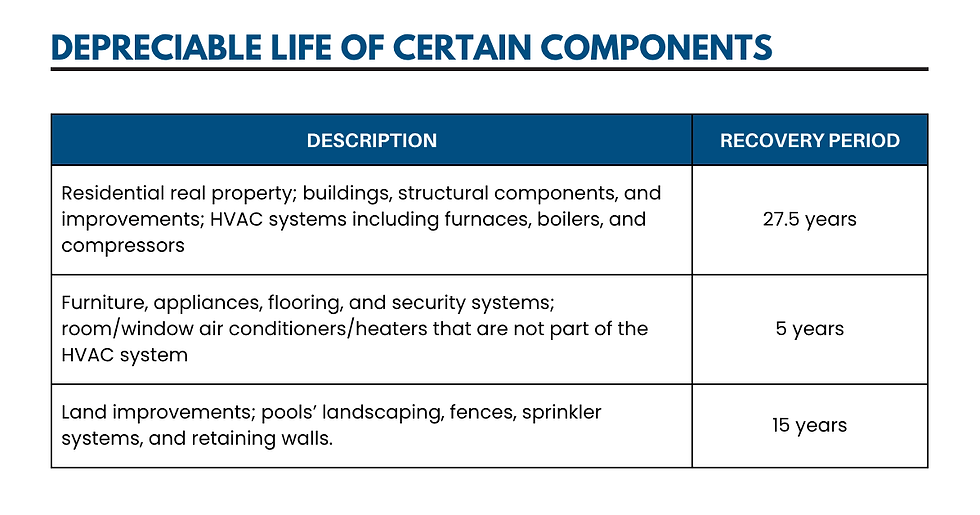

To fully take advantage of bonus depreciation, investors can utilize a Cost Segregation Study. These analyses, conducted by specialized firms with expertise in engineering and accounting, break down the property into components that can be depreciated over varying timelines (5, 15, and 27.5 years).

For example, the appliances in an apartment building will depreciate over 5 years, much faster than the building’s foundation, which depreciates over 27.5 years. Under the new legislation, investors can write off 100% of the value of all appliances in year one of ownership.

By separating out the individual components of a property and depreciating them as fast as possible (Within IRS Limitations), you can maximize your depreciation “losses” in the early years of ownership. The big idea here is that on paper, your property lost money because of the huge depreciation loss. However, these depreciation losses do not impact the property’s cash flow. Therefore, you do not pay income tax on the cash flows received from the property.

Important Note: Consult Your CPA

While 100% bonus depreciation offers significant upside, each investor’s tax situation is unique. We strongly recommend discussing this strategy with your CPA or tax advisor to ensure you qualify for the deduction and understand how it applies to your personal circumstances.

Comments